Saudi Arabia is taking important steps toward becoming a key natural gas player in the global field. In fact, this is no longer merely an attempt to diversify its energy mix; it’s much more about strategy on the global geopolitical level. Reducing dependence on oil, the kingdom will maximize the use of economic sanctions against Iran.

Iran has the world’s second biggest gas reserves. This puts pressure on Saudi Arabia to improve its gas capacities. Saudi energy ministry has recently requested state-owned Saudi Aramco to put aside plans of increasing crude oil production. The kingdom will now focus on gas after its well-thought change in the energy policy of the kingdom.

Investment in Gas Expansion

The CEO of Aramco, Amin Nasser, stressed that gas will play a major role in the company’s future. As he said, “Gas is going to take quite a bit of the upstream spending.” Compared with previous estimates, Aramco has boosted its expansion goals for gas by more than 60% by 2030.

Aramco has also obtained significant financial pledges for gas supply purchases. It features billions of dollars allocated to investment in every stage of the gas value chain. This intent on gas was reaffirmed during a Houston energy summit, where Aramco’s Senior Executive Vice President for Gas, Abdulkarim al-Ghamdi, described the company as a leading LNG player.

Greece’s Strategy Shifts Towards Natural Gas, Raising Environmental and Geopolitical Concerns

Recently, the Saudi oil company took its holding stake in MidOcean Energy to 49% for a $500 million investment. The company also said it would sign a 20-year contract to buy LNG from NextDecade’s Rio Grande project in Texas. All these are strategic plays by Aramco in the global gas market.

Domestic Demand and Future Challenges

Saudi Arabia’s gas strategy, of course, is not just about export ambitions, but also about rising domestic needs. The kingdom burns about 500,000 barrels of crude oil per day to generate power. As it makes a shift toward greater utilization of gas and renewable sources of energy, Aramco wants to replace crude in electricity generation.

Crown Prince Mohammed bin Salman believes Saudi will produce half the electricity and expect half of that to be from gas in his near vision of the future. If this is going to occur, it doesn’t detract from a wider objective of arriving at net-zero emissions by 2060. Yet, analysts question whether the kingdom has enough gas to meet these ambitious targets.

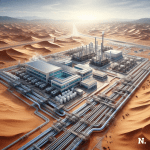

Saudi Arabia is the seventh-largest consumer in natural gas consumption. To overcome this deficit, Aramco is constructing the largest unconventional gas field in the country, Jafurah, at the cost of $25 billion. The estimate here says it holds around 229 trillion cubic feet of gas, which can cater to domestic needs as well as exports.

Despite all these plans, experts warn about high development costs of Saudi shale projects when compared with those in the U.S. However, a higher condensate-to-gas ratio might be its advantage.

Saudi Arabia Advances Nuclear Energy Program for Sustainable Growt

Geopolitical Implications

A strategic shift towards gas is replete with geopolitical implications. Saudi Arabia is seeking to exert influence further, whereas Iran is seeking to reclaim its former position in the energy market. Between the two nations, which have just restored relations, tensions still linger with her ex-ally.

Former Saudi intelligence chief Turki al-Faisal recently called for stronger measures to roll back Iranian support for various regional groups. His words reflect growing concerns about the tendencies of Iran to manipulate politics in the Middle East.

To discourage Iran and prevent it from obtaining a stranglehold in the gas market, particularly concerning Iran’s effort to lift some of the sanctions against it, Saudi Arabia welcomes this opportunity to be more solid in its presence in the gas sector.