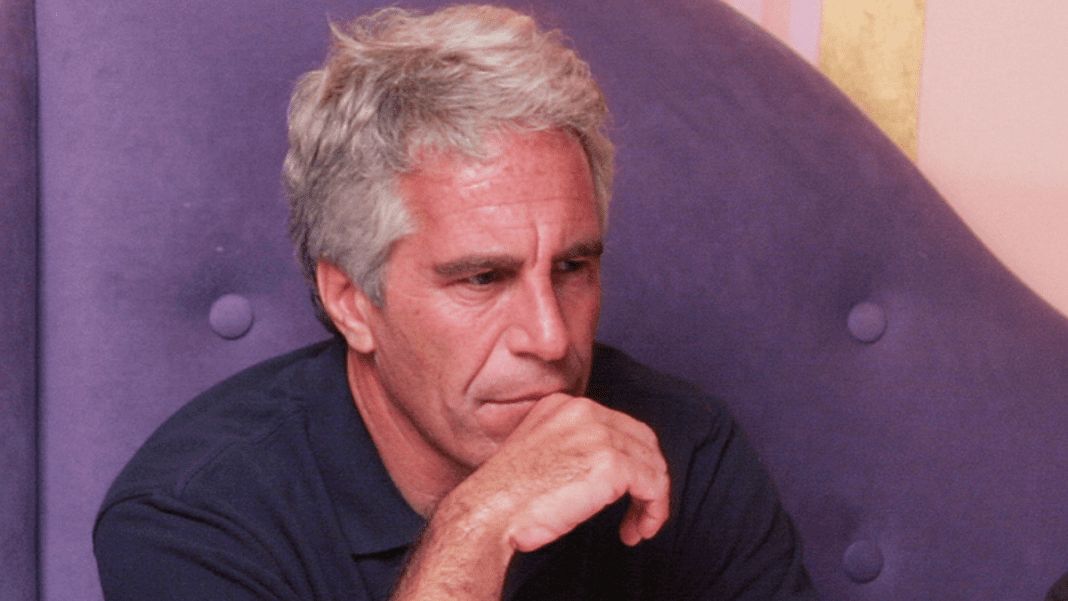

A new report has sparked outrage after it was revealed that federal investigators once looked into Jeffrey Epstein for money laundering long before his 2008 plea deal. The probe, conducted by the U.S. Attorney’s Office for the Southern District of Florida (USAO-SDFL), reportedly lasted 18 months and uncovered suspicious transactions worth tens of millions of dollars.

According to information recently revealed by a major media house, the financial investigation ran alongside the federal sex-crime case that first brought Epstein to public attention. Prosecutors allegedly found strong evidence of financial wrongdoing, including large cash withdrawals and international transfers tied to Epstein’s activities. However, the money-laundering case was never pursued. Instead, Epstein reached a plea deal that allowed him to plead guilty to lesser state charges and serve minimal jail time.

The revelation has prompted fury among lawmakers, victims, and the public. Rep. Ro Khanna, a Democrat from California, said in a recent interview that the government is “protecting people who protected Epstein.” He suggested that powerful individuals and institutions may have been shielded from scrutiny when the financial case was quietly dropped.

Financial Web and Blocked Prosecution

The report detailed that investigators had focused on Epstein’s extensive financial network, including offshore accounts and shell companies. Evidence reportedly showed that millions of dollars flowed through accounts possibly used to pay women who were victims of exploitation.

Palace panic — prince Andrew and Sarah Ferguson at breaking point as Epstein case reopens old wounds

Documents show that the lead prosecutor on the case recommended money-laundering charges against Epstein. But before any charges could be filed, then–U.S. Attorney Alexander Acosta approved a non-prosecution agreement (NPA) in 2008. That deal effectively ended the financial investigation and limited federal action against Epstein.

The decision not to pursue those charges is now under heavy criticism. Lawmakers argue that it protected not only Epstein but also people and institutions connected to him. Several major banks — including JPMorgan Chase, Deutsche Bank, and Bank of America — managed Epstein’s accounts during this time. Congressional leaders are now demanding access to bank records to determine what these institutions knew and whether they failed to report suspicious activities.

The financial probe reportedly found evidence of an unlicensed money-transmitting operation and “tens of millions of dollars in questionable transactions.” These findings, along with the prosecutor’s recommendation, have fueled claims that justice was compromised for influential figures connected to Epstein’s network.

Demands for Transparency and Accountability

Following the report, a group of lawmakers sent a formal request urging subpoenas for the banks involved, saying full transparency is needed to expose how Epstein’s finances were handled. They insist that the American public deserves to know why the money-laundering case was dropped despite strong evidence.

Rep. Ro Khanna has become one of the most vocal critics of how the case was handled. He said the government failed the victims and the justice system by allowing financial crimes to go unpunished. His comments reflect growing frustration over the perception that the wealthy and well-connected were treated differently from ordinary citizens.

Victims and their advocates have echoed these calls, saying that the truth about Epstein’s finances could reveal who enabled his operations. They believe that following the money will uncover a broader network of individuals who benefited from his crimes or helped conceal them.

The Department of Justice and the U.S. Attorney’s Office in Florida are now under renewed scrutiny for their handling of the earlier probe. Lawmakers are pressing for the release of all related documents, including communications between prosecutors and financial institutions.

Public reaction has been swift, with many questioning how such a major investigation could remain hidden for so long. Critics say the case underscores deep flaws in how financial crimes tied to powerful individuals are investigated.

This new revelation adds another layer to the ongoing Epstein saga — one that moves beyond his sex crimes and points to a vast financial web that may have been deliberately ignored. For many Americans, the idea that a major money-laundering probe was halted only strengthens the belief that the justice system protected the powerful while failing Epstein’s victims.