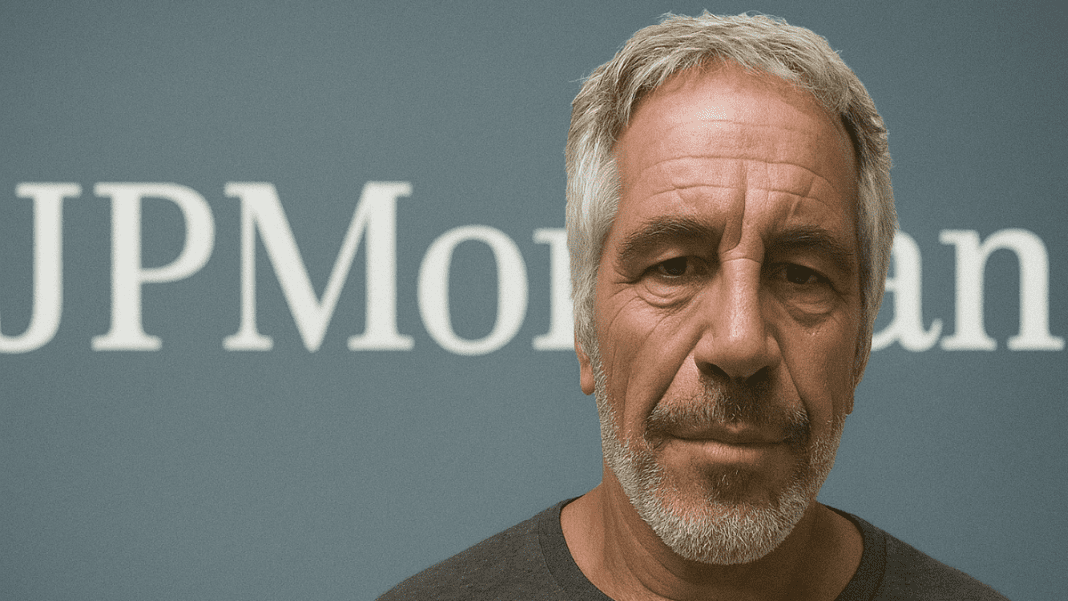

JPMorgan Chase, one of America’s biggest banks, had a long and complicated relationship with Jeffrey Epstein, the notorious financier who was also a convicted sex offender. While most people remember Epstein for his crimes against young women, his financial dealings reveal another troubling story. Reports show that the bank not only handled Epstein’s money but also benefited financially from him.

Epstein’s Money Moves Through JPMorgan

During the years when Epstein was abusing teenage girls and young women, JPMorgan processed more than 4,700 transactions for him. These transactions totaled over $1.1 billion. Some payments went directly to his victims. The bank also sent money to Russian and Eastern European accounts that were connected to Epstein’s operations.

JPMorgan allowed Epstein to withdraw tens of thousands of dollars each month. These large withdrawals should have been a warning sign for suspicious activity. In some cases, the bank opened accounts for Epstein’s assistants and victims without proper checks. Experts say this could have helped Epstein move money easily and continue his crimes.

Bank employees noticed red flags early on. Some staff members raised concerns in 2006, after Epstein was arrested for soliciting a teenage girl. They highlighted unusual cash withdrawals and the risk to the bank’s reputation. Yet, despite these warnings, the bank continued to serve Epstein.

A Profitable Yet Risky Client

Epstein was a high-value client for JPMorgan. He brought in profits and helped the bank connect with other wealthy individuals. He even advised the bank while serving jail time in Florida. This included guidance on major investments and navigating challenges like the fallout from the Madoff Ponzi scheme.

At the center of the bank’s connection with Epstein was one of its top executives. This executive had a close personal and professional relationship with Epstein. They visited Epstein’s properties, sought his advice on salaries and business growth, and relied on him for strategic ideas.

From campaign cash to foreign lobbying: Pam Bondi’s past resurfaces in Epstein storm

The relationship went beyond business. Reports indicate that the executive had inappropriate personal interactions with one of Epstein’s assistants. The woman later said in legal filings that Epstein forced her and other victims into commercial sex with friends of the financier.

JPMorgan spokespersons said the bank regrets its relationship with Epstein and called it a mistake. They insisted the bank did not help Epstein commit his crimes.

Leadership Questions and Oversight

Concerns about Epstein’s accounts reached the bank’s top leadership multiple times. Internal notes suggest that some decisions about his accounts were “pending review” by the bank’s chief executive. Despite this, the accounts remained active for years.

The chief executive has said he did not know much about Epstein until 2019. However, records show that the executive may have been briefed at least twice about Epstein. Lawyers representing Epstein’s victims said that either the executive knew about Epstein and did not disclose it, or the information never reached him—both scenarios raising serious questions.

Political Firestorm: Speaker Mike Johnson alleges Trump was FBI informant after Epstein expulsion

The internal investigations and legal filings paint a picture of a bank that repeatedly chose profit over caution. Employees’ warnings about suspicious activity and the risk to the bank’s reputation were ignored. Epstein continued to be a lucrative client while raising serious ethical and legal concerns.

The full extent of JPMorgan’s involvement with Epstein comes from over 13,000 pages of legal and financial records, including internal memos and depositions. The documents show that Epstein’s money moved through the bank for years, highlighting how closely the financier and the bank were tied financially.