Reflecting on the success of our celebrated list of top AML influencers from last 2 years, we are excited to continue this tradition in 2024. This year, we honor the achievements of exceptional AML professionals who have set benchmarks in their field with their dedication and expertise.

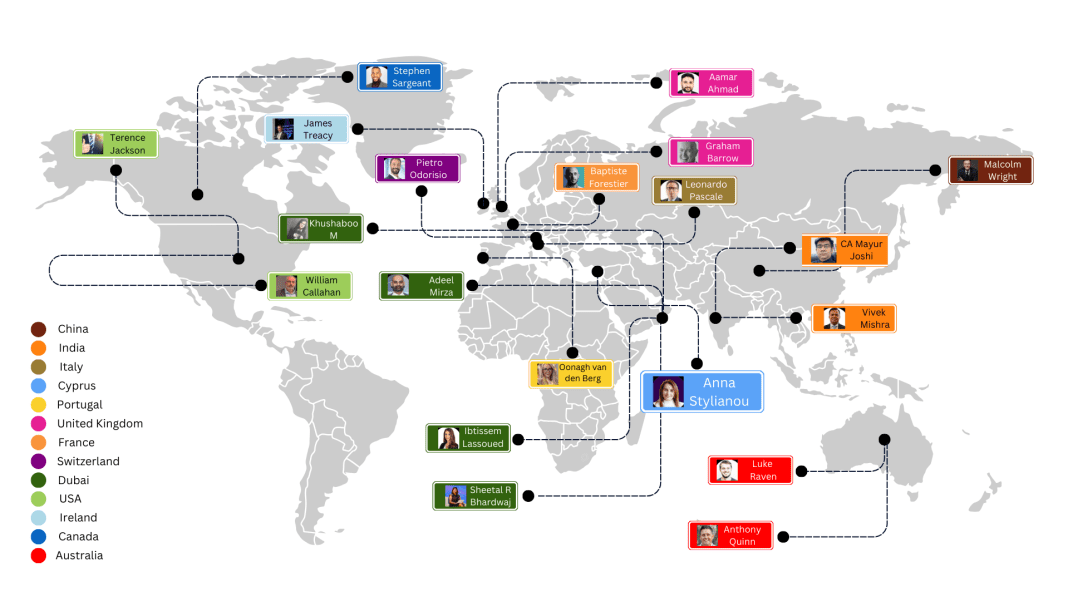

Join us as we uncover the profiles of the top 20 most influential AML professionals from around the globe. From bustling New York to vibrant Hong Kong, our analysis focuses on LinkedIn activity, evaluating metrics such as follower count, engagement rates, and posting frequency. This comprehensive ranking showcases individuals who consistently captivate their audiences and drive meaningful conversations in the AML sector.

Dive into the stories behind these trailblazers and explore the traits that make them standout leaders in the ever-evolving world of AML.

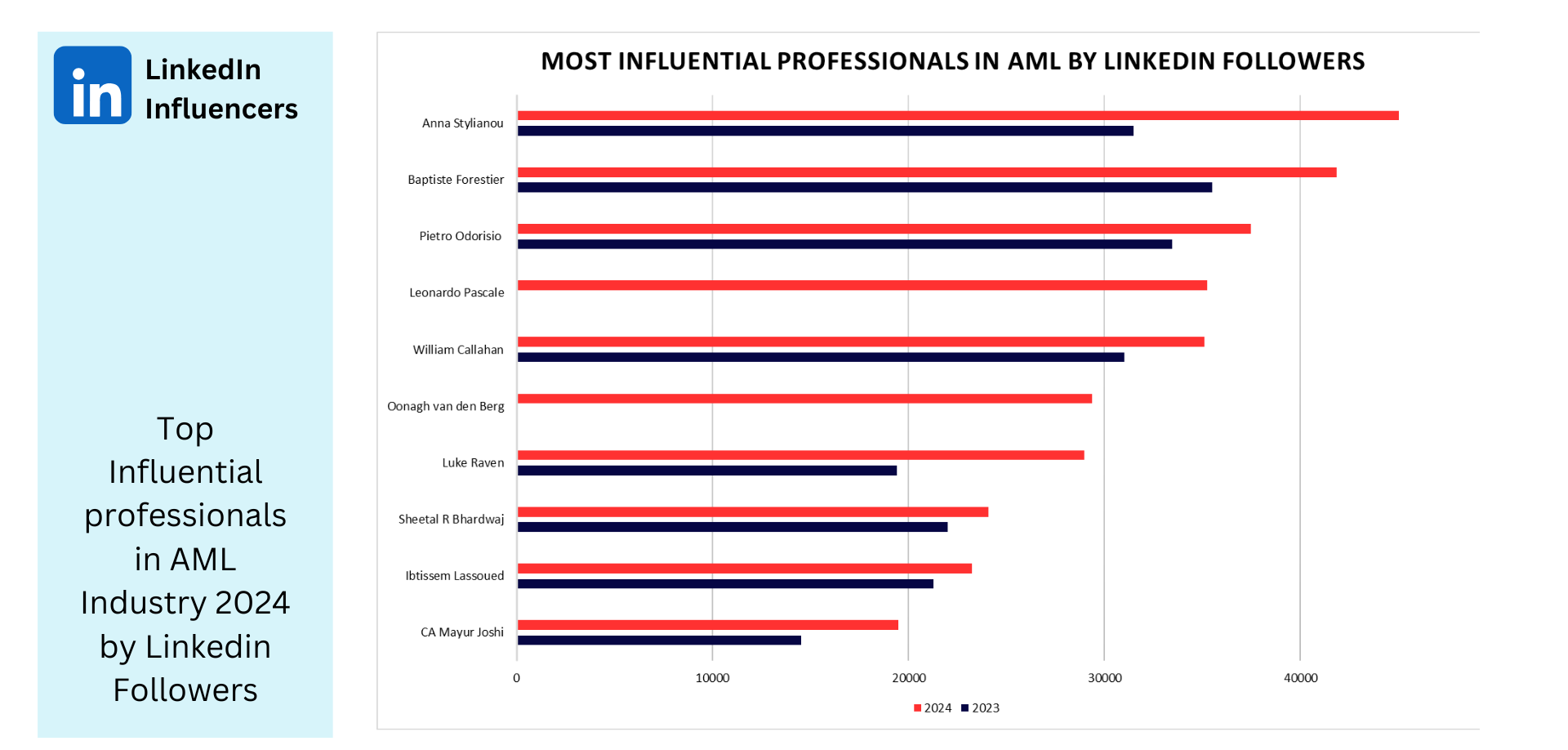

Please note: Leonardo Pascale and Oonagh van den Berg were added to the list in 2024; therefore, their follower count for 2023 is unavailable.

Anna Stylianou

Anna Stylianou is a dedicated compliance officer from Cyprus, specializing in combating money laundering within the cryptocurrency sector. Known for her influential presence on LinkedIn, she consistently achieves a remarkable engagement rate with her posts, sparking significant interactions. Her unwavering commitment to her work has earned her widespread recognition, establishing her as a prominent leader in the industry.

In addition to her role as a compliance officer, Anna serves as an Expert Advisor for Anti-Financial Crime and AML at Optima Board Services Group. A prolific content creator, Anna’s expertise spans global financial crime regulations. She uses her extensive knowledge to help companies and brands navigate AML/KYC regulations while also educating their clients. As an experienced AML program trainer, Anna founded AML Cube Consulting and Education, a company focused on creating training programs that ensure financial entities and businesses remain up-to-date with compliance standards and regulations. Anna is an alumna of the University of Manchester, where she earned a Bachelor’s degree with honours in Retail Financial Services.

Baptiste Forestier

Baptiste Forestier is a highly respected French compliance officer, widely recognized for his expertise in compliance and anti-money laundering (AML). He is the founder of The Laundromat podcast, a platform designed for professionals in the field. Through engaging discussions on key AML concepts and methodologies, as well as insightful interviews with industry experts, Baptiste offers valuable perspectives on money laundering and fraud prevention. A graduate of Université d’Auvergne with a Master’s degree in Business and Bank Law, Baptiste currently serves as the Chief Compliance Officer at LinkCy in Paris. His ascent to the top spot in this year’s rankings, up from sixth place, reflects his growing influence and leadership in the AML sector.

Pietro Odorisio

Pietro Odorisio is a skilled AML Consultant (Full-time, Freelance) from Lugano, Switzerland, with a strong foundation in financial crime prevention and communication. He holds a Master’s degree in Communication, Institutional Relations, and Public Affairs from Il Sole 24 ORE Business School and a Bachelor’s degree in Political Philosophy and Business Ethics from Università degli Studi di Roma Tre.

Previously a Business Development Specialist at SGR Compliance, Pietro combines expertise in AML/KYC processes with a background in public relations and editorial work. Now, as a freelance consultant, he crafts compliance solutions and shares insightful articles on money laundering, terrorist financing, and regulatory updates, fostering greater understanding and awareness of financial crime risks.

Leonardo Pascale

Leonardo Pascale is a highly experienced Compliance Manager specializing in anti-money laundering (AML) and internal controls, with over a decade of expertise in financial risk management. With a proven track record in leading banking institutions, Leonardo has implemented comprehensive measures to address embargoes and sanctions in compliance with Regulation 231/07. Currently focused on enhancing AML processes to ensure compliance and efficiency, Leonardo has spearheaded projects such as developing IT-driven monitoring databases and creating new compliance forms to strengthen regulatory frameworks.

Leonardo Pascale is deeply committed to promoting ethics and transparency in the compliance field. He is an active member of prominent professional organizations such as ANALISIBANKA, AIRA, and ASSOAML, and is also a co-founder of AML-LAB. Through these affiliations, Leonardo fosters collaboration with industry professionals and institutions, further strengthening his expertise and solidifying his reputation as a leading authority in the AML sector.

William Callahan

William Callahan, a former DEA agent with over 20 years of experience, has transitioned into Anti-Money Laundering (AML) and financial crime prevention. With a Master of Arts in Criminal Justice, he held key roles, including Special Agent in Charge of the DEA St. Louis Division. After retiring, he worked at Blockchain Intelligence Group, building relationships with law enforcement and financial institutions, and now runs his own consulting firm, WJC3 Solutions, LLC.

William is recognized as one of the Top 20 Most Influential Professionals in AML and holds certifications like Certified Fraud Examiner (CFE). He has received awards for fostering collaboration between law enforcement and the private sector, and continues to make a significant impact in financial crime prevention.

Oonagh van den Berg

Oonagh van den Berg is a globally recognized compliance expert with over 20 years of experience in traditional banking, fintech, and cryptocurrency. She is the founder of Virtual Risk Solutions (VRS), where she leads businesses in regulatory licensing, risk framework development, and education. Additionally, she is the visionary behind RAW Compliance, a global platform providing free training, upskilling, and mentorship for compliance professionals. Oonagh has worked with top institutions like HSBC, Citi, and ING, and has guided fintech and crypto firms, including Uphold, through regulatory licensing and GRC build-outs.

A graduate of the European Central Bank’s DG Legal program, Oonagh is also a passionate advocate for working mothers, challenging workplace biases and raising awareness about the struggles women face balancing careers and motherhood. Her influence extends to shaping the compliance sector globally as a sought-after speaker and thought leader at conferences and industry events.

Luke Raven

Luke Raven, a Senior Partner in the Group Risk Division at the Bank of Queensland, is ranked 6th among LinkedIn Top Voices in AML/CTF compliance. With expertise in fraud risk, KYC, ECDD, sanctions, and their practical applications, Luke has worked with major players like Westpac, Wise, and Wirecard. His approach to compliance focuses on exceeding industry standards to protect both businesses and customers.

A thought leader in the field, Luke shares insights through articles on RegTech and FinTech websites. His commitment to disrupting financial crime and balancing customer experience has earned him recognition, moving from 15th to 6th place. Luke advocates for effective compliance programs that go beyond the minimum, ensuring what’s right for businesses, customers, and the community.

Sheetal R. Bhardwaj:

Sheetal R. Bhardwaj is an experienced risk and compliance professional, currently serving as the Head of Virtual Assets Compliance at the Commercial Bank of Dubai. She holds multiple certifications, including CAMS, CFE, CGSS, CCI, and CCO, along with qualifications in Compliance & AML from CISI, UK, and ICA Manchester Business School.

With over two decades of experience in banking and financial services, Sheetal is approved by the UAE Central Bank and DFSA for senior management roles. She is a permanent member of the Risk Management Oversight Committee and has expertise in regulatory compliance across MENA countries and internationally. Sheetal has been recognized for her work, including nominations for the C5 Women in Compliance Awards and Middle East Legal Awards.

Ibtissem Lassoued

Ibtissem Lassoued is a distinguished global speaker and Partner at Al Tamimi & Company, where she heads the regional financial crime advisory practice. Specializing in complex cross-border criminal matters, her expertise covers corruption, money laundering, terrorist financing, economic sanctions, cybercrime, fraud, and extradition.

In February 2021, Ibtissem was appointed Chair of the Global Coalition to Fight Financial Crime MENA Chapter, leading the organization’s regional activities. She is also an active speaker and thought leader, addressing governance, commercial, and regulatory aspects of financial crime and geopolitical challenges at global events.

CA Mayur Joshi

CA Mayur Joshi, a distinguished anti-money laundering expert with over 20 years of experience in Financial Crimes, holds a prominent position in Risk Management, recognized by Thinkers 360 as one of the most influential professionals. Additionally, he serves on the board of Rashtra Raksha University, a University of National Significance.

As the founder of Indiaforensic, a global community with over 5000 members, Mayur has established Indiaforensic as a hub for AML education. Renowned for its Certified Anti Money Laundering Expert (CAME). course, it is widely regarded in the Indian Subcontinent.

Mayur’s influence extends to the cybersecurity domain, where he serves as a board member of EC-Council, a leading educational institute. With a prolific writing career, he has authored 8 books on Anti Money Laundering and financial crimes. His insights are regularly featured in newspapers and research papers, showcasing his authority in the field. Mayur stands out as a thought leader among AML influencers, contributing regularly on LinkedIn and shaping the discourse in the industry.

Graham Barrow

Graham Barrow is a seasoned professional with extensive experience in senior roles across global banking, markets, corporate, private, retail, and wealth management. He currently serves as a director for The Dark Money Files Ltd., where he applies his deep understanding of regulations, legislation, guidance, and best practices to develop effective financial crime policies and controls.

Having worked in locations worldwide, including London, Hong Kong, Singapore, and several others, Graham has made significant contributions to policy development in wealth, private banking, correspondent banking, and trade finance. He has been closely involved in two Systematic AML Programs (SAMLPs) and is known for his expertise in financial crime controls. Additionally, Graham shares his insights on AML through LinkedIn articles and updates and holds the 9th position this year in global AML thought leadership.

Stephen Sargeant

Stephen Sargeant, a distinguished compliance consultant and blockchain expert from Toronto, Canada, is highly educated in Finance and Financial Management Services, with a background from Centennial College. He further honed his expertise through the Canadian Institute for Financial Crime Analysis’s Financial Crime Analysis Program.

Stephen is the founder and Chief Web3 Officer of Airdropd Inc., a media production house focused on content creation for cryptocurrency and Web3 companies, helping them amplify their brand and build communities. He also hosts the podcast We Were On A Break and is a faculty member at the Canadian Institute for Financial Crime Analysis, where he provides blockchain compliance training. Passionate about bridging the gap in blockchain investigations, he trains professionals in AML and compliance, preparing them for careers in crypto compliance. Additionally, Stephen offers consultancy services to banks and MSBs, helping them build strong crypto compliance teams and develop internal policies.

James Treacy

James Treacy, an anti-financial crime professional based in Ireland, serves as the CEO and co-founder of AML Intelligence. His educational background includes a PG diploma in International Selling, Business, Management, Marketing, and related support services from the Technological University of Dublin.

With an entrepreneurial spirit, James has founded notable ventures, including BusinessPro consulting, StubbsGazette, and the International Fraud Prevention Conference. The latter, dedicated to combating fraud through technological innovations, showcases his commitment to advancing the field.

Currently, James is immersed in his venture, AML Intelligence, where he channels his expertise to assist businesses in combating financial crime and ensuring compliance with relevant regulations. His multifaceted approach reflects a dedication to both innovation and ethical business practices.

Terence Jackson

Terence Jackson, based in Texas, USA, is a cybersecurity expert, accountant, and award-winning publisher with over 20 years of experience in IT, security, and compliance. He holds degrees in Accounting, Information Systems, and an MBA, along with a certificate in Cybersecurity and Data Privacy.

Currently serving as the Regional Financial Risk, Controls, and Compliance Coordinator at CRH, Terence has held leadership roles at Cypress Semiconductor and CD&P. He advises organizations on cybersecurity strategies, mentors future IT leaders, and supports startups with product development.

As the founder of InFluential Magazine Media and The Cyber Deacon, Terence combines innovation, faith-based principles, and a commitment to creating safer digital spaces.

Adeel Mirza

Adeel Mirza, based in Dubai, is a Certified Anti-Money Laundering Specialist, Certified Blockchain and KYC Professional, and Cryptocurrency Auditor with over 16 years of expertise. His experience spans AML, sanctions compliance, GDPR data protection, and regulatory frameworks across the banking, money services, investment, asset management, and telecommunications industries.

Adeel holds a BCom in Accounting and Finance from the University of Karachi. He has worked with renowned institutions such as Commercial Bank of Dubai, Delma Exchange, Noor Bank, and Protiviti Middle East, excelling in compliance, auditing, and regulatory transformation projects. His hands-on experience includes implementing AML frameworks and leading large-scale transformation initiatives.

Currently, Adeel serves as Head of AML and KYC at the Arab Bank for Investment & Foreign Trade (Al Masraf) in the UAE. A skilled public speaker, Adeel actively participates in conferences, webinars, and training events, sharing his expertise. His professional footprint includes the UAE, Kuwait, Bahrain, Saudi Arabia, Kenya, and Pakistan.

Anthony Quinn

Anthony Quinn, based in Sydney, Australia, is a leading RegTech and AML expert with over 20 years of experience in financial crime compliance and risk management. He holds a Bachelor’s in Business Administration from the University of Bath and is an AUSTRAC Approved External Auditor.

Anthony founded Arctic Intelligence in 2015, a global RegTech firm specializing in compliance and risk software, and co-founded AML Accelerate in 2016 to streamline AML/CFT risk assessments. Arctic Intelligence, which acquired AML Accelerate in 2018, has won multiple awards, including the 2020 Australian Founded RegTech of the Year.

Previously, Anthony led major compliance programs at Macquarie Bank, Westpac, and NAB, and consulted for global firms like Goldman Sachs and JP Morgan at Accenture. He serves on the RegTech Association Advisory Committee and enjoys family time on Sydney’s Northern Beaches.

Aamar Ahmad

Aamar Ahmad, a seasoned Subject Matter Expert in Anti-Financial Crime, brings extensive expertise to Investment Banks, Private Banks, multinational oil and gas companies, and FinTechs. Known for his impactful global training sessions across Europe and Africa, Aamar focuses on modules such as AML Risk Assessment, Money Laundering, Correspondent Banking, and Trade Finance Compliance.

As the Founder and CEO of Sigma Risk Limited, Aamar provides comprehensive advisory services, including AML, Financial Crime, Trade Finance, Sanctions, Client Risk Reviews, and tailored Training and Coaching programs. His expertise extends to Section 166 advice, policy gap analysis, remediation projects, thematic reviews, and the development of risk assessment methodologies. Aamar also conducts onsite client reviews and supports regulatory and remediation projects.

Aamar’s professional qualifications include Cyber Risk Assessment Masterclass (ICTTF), ICA Fellow Membership, and ICA Certified Practitioner status. His dedication to mitigating financial crime and delivering bespoke compliance solutions makes him a highly sought-after advisor in the industry.

Malcolm Wright

Malcolm Wright, based in Hong Kong, is a globally recognized leader in AML and crypto regulation. Renowned for his work with the FATF and expertise in applying AML principles to blockchain, he has shaped compliance frameworks for crypto, FinTech, and traditional finance sectors. Currently, Head of Regulatory at OKX, Malcolm has held senior roles at Revolut, Eqonex, and BitMEX, and was pivotal in establishing the Dubai Virtual Assets Regulatory Authority’s licensing frameworks.

As founder of InnoFi Advisory and an award-winning entrepreneur, he has advanced innovations like the FATF Travel Rule, NFTs, DAOs, and DeFi strategies. A frequent global speaker, Malcolm advises policymakers and chairs the Global Practitioners Advisory Board at the International Compliance Association, driving alignment between technology and compliance.

Khushaboo M

Khushboo M, with over 6 years of experience in banking and MSB compliance, specializes in analyzing and monitoring suspicious activities using AML software. She ensures timely reporting in line with AML/CFT/CPF guidelines and applies a risk-based approach to combat money laundering, terrorist financing, TBML, and proliferation financing.

Her expertise is reinforced by certifications in Advanced AML, Trade-Based Money Laundering, Sanctions Updates, Blockchain Technology, and crypto-related risks. A proactive team player, Khushboo is dedicated to delivering high-quality outcomes and improving compliance processes.

Vivek Mishra

Vivek Mishra is a seasoned business professional with over 15 years of experience, specializing in AML & KYC compliance, risk mitigation, data analysis, and fraud prevention. His expertise spans across various sectors, including banking, finance, and insurance, where he has consistently delivered strong compliance outcomes and reduced operational risks. He is highly skilled in conducting due diligence, analyzing complex data, and managing projects to ensure compliance with AML/KYC regulations.

Vivek holds certifications such as CAMS (Certified Anti-Money Laundering Specialist) and Lean Six Sigma Black Belt, reflecting his commitment to professional growth and excellence. He has a proven track record of developing and implementing risk mitigation strategies, managing AML/KYC remediation efforts, and resolving compliance issues. His ability to identify patterns in customer transactions and prevent fraudulent activities has played a key role in enhancing organizational risk management.

As a leader, Vivek has successfully managed cross-functional teams, ensuring timely execution of AML/KYC compliance initiatives. He also excels in providing guidance and training to junior team members, helping them strengthen their understanding of compliance requirements. His collaborative approach and dedication to regulatory adherence have made him an invaluable asset in driving compliance excellence across organizations.

Wishing everyone a Happy New Year in advance! As we wrap up our list of top AML influencers, we recognize the outstanding impact these professionals have made in shaping the AML field. If your name isn’t on this list, we encourage you to submit your details through our form, giving you the chance to be included in our upcoming influencer showcase.