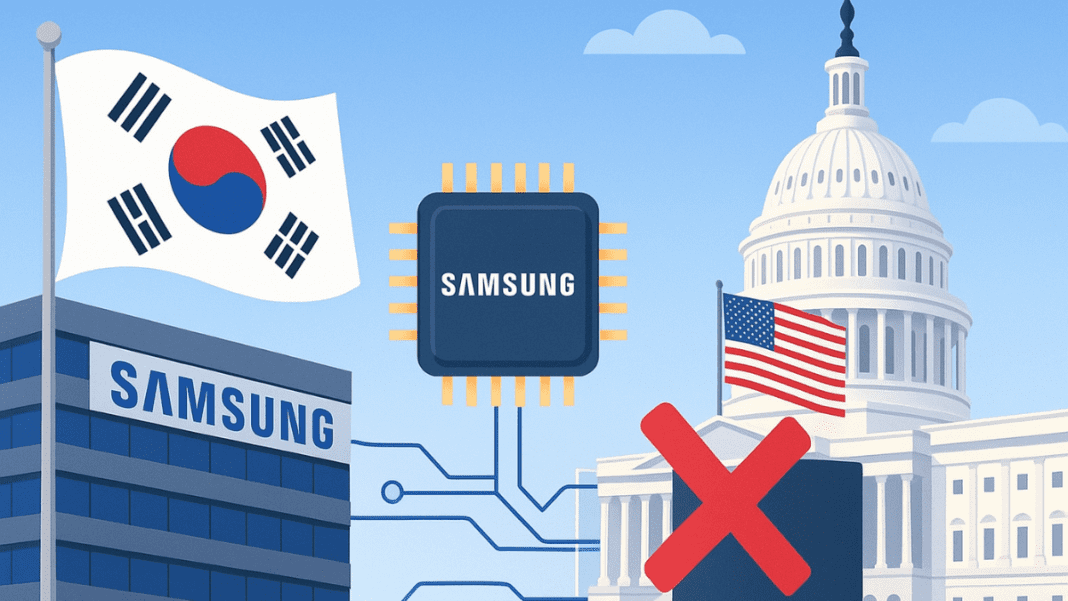

South Korea has denied rumors that the U.S. government is planning to buy shares in Samsung. The presidential office, known as the Blue House, called the reports unfounded and said there are no such talks taking place.

Blue House rejects rumors of U.S. stake in Samsung

The speculation started after news broke that Washington is considering acquiring a 10% equity stake in Intel. This move was linked to the CHIPS Act, a program created to support chipmakers in building and expanding factories in the United States. Reports suggested that this deal could extend to other companies that also received CHIPS Act funds, including Samsung.

The U.S. approved over $6 billion from the program to help Samsung finance its large chip factory project in Taylor, Texas. Even though Intel has been granted a much larger amount, rumors of U.S. ownership of Samsung quickly spread. The idea of a foreign government holding shares in one of South Korea’s biggest companies stirred debate and worry across its political and business circles.

Why Samsung matters so much to South Korea

Samsung is not just another company in South Korea. It is considered the country’s crown jewel and one of the largest tech firms in the world. Some estimates say that its revenue alone accounts for about one-fifth of South Korea’s entire economy.

How Cyber Attacks on Industrial Control Systems Can Endanger Lives ?

The company plays a central role in jobs, exports, and innovation, making it deeply tied to the country’s national pride. Despite facing several corporate scandals over the years, the government has always stepped in to make sure that the company remains stable and independent.

This is why many in South Korea see the suggestion that another country — even a close ally like the United States — could take ownership of Samsung shares as highly sensitive. They view such a move as foreign influence over a company that symbolizes the nation’s strength in technology and global trade.

What the U.S. stake debate means for Samsung

The United States’ interest in taking equity stakes in chipmakers comes from its effort to strengthen domestic semiconductor production. Under the CHIPS Act, the U.S. government has granted billions of dollars to companies like Intel and Samsung to boost factory construction and chip supply security.

In Intel’s case, reports say Washington is weighing a deal to acquire a 10% stake in exchange for the billions it has already invested. There was also talk that the U.S. may want to apply a similar model to other recipients of CHIPS Act funds, including Samsung.

If the U.S. were to pursue such a stake in Samsung, major questions would need to be answered. Would owning a part of Samsung mean that American officials could join the company’s board of directors? Would the U.S. gain influence in how Samsung makes its decisions? Or would it simply be an investment that provides returns in the form of dividends?

Insider revenge cyberattack freezes 1,000 workers — Eaton hit with massive disruption and losses

These uncertainties underline why South Korea has reacted strongly to the rumors. Allowing any form of foreign ownership in Samsung could reshape the company’s structure and raise concerns about its independence.

Other countries have seen government stakes in major chipmakers before. Taiwan’s TSMC, for example, has partial ownership by the Taiwanese government, and Singapore’s wealth fund also holds shares in its own tech giants. But South Korea has always kept Samsung under local control, and that tradition continues to shape the government’s stance today.

For now, the Blue House’s message is clear. The United States has no plans to acquire Samsung shares. The government is focusing on existing CHIPS Act funding. This funding supports Samsung’s Texas chip factory. It also expands U.S.-South Korea cooperation in technology. Ownership of Samsung will not change.