As we reminisce about our shared and awarded list of top AML influencers last year, we are thrilled to announce the continuation of this tradition in 2023. Join us in celebrating and recognizing the outstanding contributions of AML professionals who have consistently demonstrated excellence in their field.

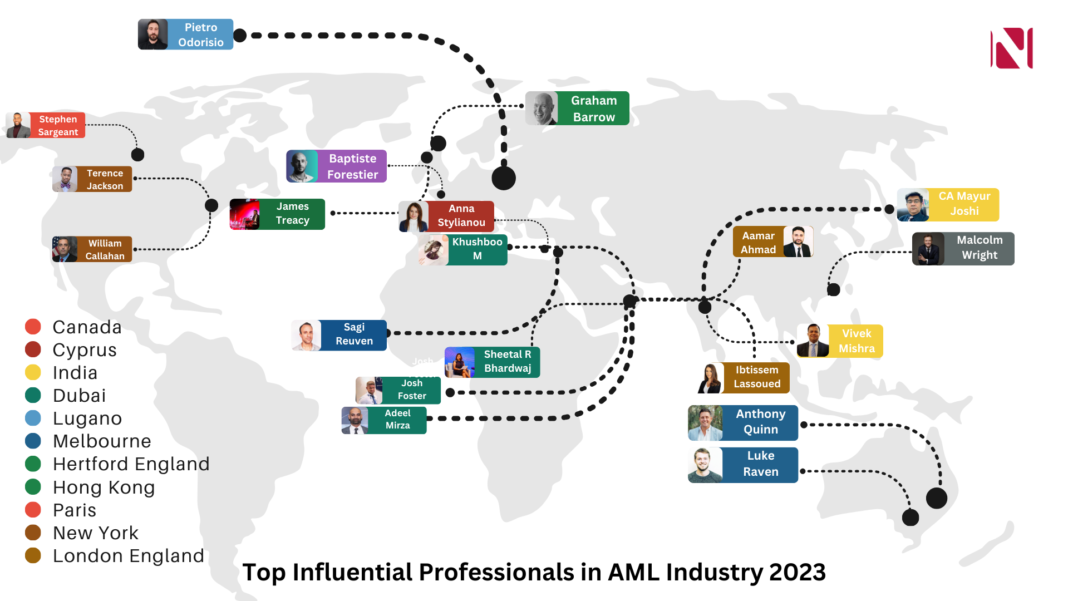

Embark on a journey with us as we delve into the profiles of the top 20 most influential AML professionals worldwide. From New York to Hong Kong, our study is centered on the LinkedIn profiles of these professionals who engage with their audience with remarkable frequency. We’ve meticulously compiled a list, ranking these professionals based on parameters such as followers, engagement rate, and the frequency of posting.

Read Here: Rankings for AML Influencers of 2022

Let’s explore what makes these individuals stand out and discover the exceptional qualities that contribute to their influence and success in the dynamic world of AML.

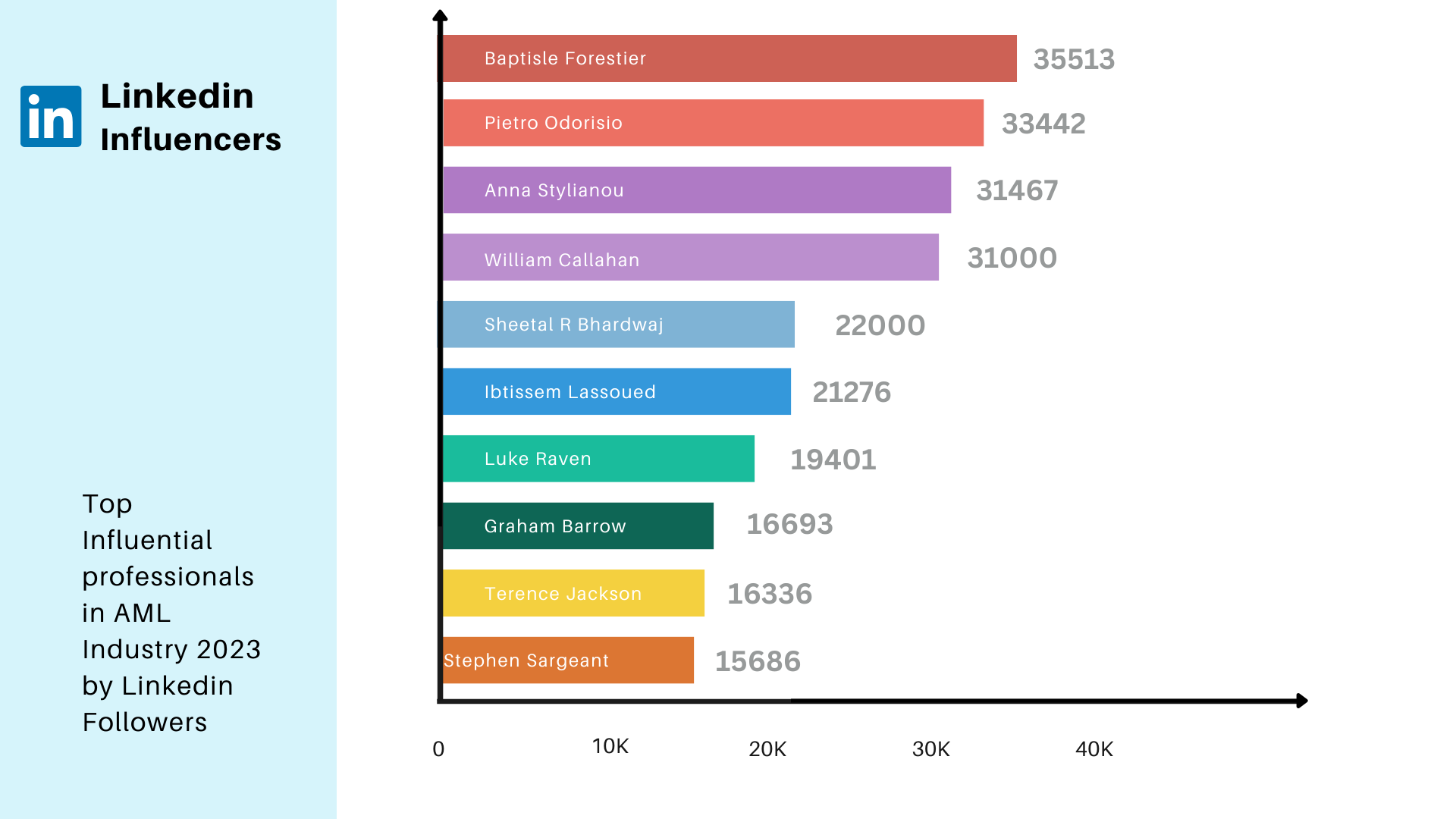

Most Influential Professionals in AML by LinkedIn Followers

Baptiste Forestier

Baptiste Forestier a distinguished French compliance officer and the host of ‘The Laundromat’ podcast, has significantly risen in influence over the past year. Renowned for his expertise in compliance and anti-money laundering (AML) matters, Baptiste initiated ‘The Laundromat’ podcast to cater to professionals in the field. Through engaging discussions on various AML concepts and methodologies, along with insightful interviews featuring seasoned experts, he provides valuable perspectives on money laundering and fraud cases. Baptiste, an alumnus of Universite D’Auvergne with a Master’s degree in Business and Bank Law, presently holds the position of Chief Compliance Officer at LinkCy, situated in Paris. Notably, he has ascended to the top spot in this year’s list, surpassing his previous sixth position, a testament to his continued impact and leadership in the AML community.

Pietro Odorisio

Pietro Odorisio, a skilled financial crime data analyst from Lugano, Switzerland, holds a Master’s degree in Communication and a Ph.D. in Political Philosophy and Business Ethics. Formerly a public relations officer and editor, he now excels as a Financial Crime Data Analyst at SGR Compliance. Pietro seamlessly blends his writing prowess with AML expertise, sharing insightful articles with his audience. Covering topics ranging from money laundering and terrorist financing to compliance and AML/KYC news and procedures, he fosters awareness and understanding in these critical areas.

Anna Stylianou

Anna Stylianou a dedicated compliance officer from Cyprus, specializes in combating money laundering within the crypto sector. Renowned for her influential presence on LinkedIn, she holds a remarkable engagement rate, with posts that spark significant interactions. Anna, who secured the 3rd position this year, has shown exceptional growth, moving up from the 7th spot in the previous ranking. Her consistent commitment to her work is truly commendable.

A prolific content creator on LinkedIn, Anna’s expertise extends to global financial crime regulations. Leveraging her knowledge, she actively assists companies and brands in navigating AML/KYC regulations and educates their clientele. With a background as an AML program trainer, Anna founded AML Cube Consulting and Education, dedicated to developing training programs that keep financial entities and companies well-versed in compliance measures and regulations. Anna Stylianou is an alumna of the University of Manchester, where she earned her Bachelor’s Degree in Retail Financial Services with honours.

William Callahan

William Callahan, a former United States Drug Enforcement Administration (DEA) agent, has seamlessly transitioned into the realm of Anti-Money Laundering (AML). Armed with a background in Criminal Justice and Police Science from the University of New Brunswick and a Master of Arts in Criminal Justice from John Jay College, his academic foundation is robust.

Prior to his two-decade tenure with the DEA, William honed his AML and KYC expertise in the Asset Forfeiture and Money Laundering Unit at the United States Attorney’s Office for the District of New Jersey. Post-retirement, he contributed his wealth of experience to the Blockchain Intelligence Group, and now he runs his own firm, WJC3 Solutions, LLC, providing AML and training consultation.

Sheetal R Bhardwaj

Sheetal R. Bhardwaj, a seasoned risk and compliance specialist, adeptly leads teams in executing comprehensive compliance activities. Currently serving as the Head of Virtual Assets Compliance for the Commercial Bank of Dubai, Sheetal holds certifications in Compliance & AML from CISI, UK & ICA Manchester Business School.

Her international certifications include Certified Anti Money Laundering Specialist (CAMS), Certified Fraud Examiner (CFE), Certified Global Sanctions Specialist (CGSS), Certified Crypto Investigator (CCI), and Certified Compliance Officer (CCO). She is a distinguished permanent member of the Risk Management Oversight Committee, showcasing her commitment to maintaining high standards in risk and compliance.

Ibtissem Lassoued

Ibtissem Lassoued, a distinguished global speaker from the UAE, serves as a partner and the head of the advisory for Al Tamimi & Company’s regional financial crime practice. Specializing in international criminal cases, she provides expert counsel on matters such as fraud, extradition, economic sanctions, cybercrime, and terrorism financing.

In February 2021, Ibtissem was appointed as the Chair of the Global Coalition to Fight Financial Crime MENA Chapter, overseeing the organization’s activities in the region. Beyond her role, she actively contributes to thought leadership on governance, business, and regulatory aspects of financial crime, and addresses related geopolitical challenges through her numerous speaking engagements worldwide.

Luke Raven

Luke Raven, a Senior Partner in the Group Risk Division at the Bank of Queensland, holds a prominent position as a Linkedin Top Voice in AML/CTF Compliance. With extensive expertise in fraud risk, KYC, ECDD, sanctions, and their practical applications, Luke has contributed significantly to the financial domain. His impressive career includes stints with major players such as Westpac, Wise, and Wirecard.

As a thought leader, Luke actively shares his work and experiences with his followers, and his articles are featured on various leading RegTech and FinTech reporting websites. Notably, he has made remarkable progress, ascending from the 15th position last year to the 8th position, a testament to his ongoing dedication and impact in the field. Keep up the excellent work!

Graham Barrow

Graham Barrow, with extensive experience in top positions across global banking, markets, corporate, private, retail, and wealth management, currently serves as a director for The Dark Money Files Ltd. Through his roles, he has garnered a comprehensive understanding of supporting rules, laws, instructions, and case studies of best practices.

Graham has played a pivotal role in shaping effective policies in areas such as wealth, private banking, correspondent banking, and trade finance, making significant contributions to their development. Engaged in two Systematic AML Programmes (SAMLPs), Graham shares his expert insights on AML through articles and updates on LinkedIn. Notably, he has maintained a strong presence, holding the 9th position this year after securing the 10th position last year. Keep up the excellent work!

Terence Jackson

Terence Jackson, based in Texas, USA, is a seasoned accountant, professional speaker, and award-winning publisher specializing in board governance, compliance, and risk. His extensive education includes an Associate of Science from Sinclair Community College, a Bachelor of Science in Accounting from Wright State University, and a Master in Business Administration from the University of Phoenix.

Terence is recognized for his managerial prowess, having held leadership roles such as Compliance Manager at Cypress Semiconductor Corporation and Director of Accounting and Contract Management at CD&P. Currently, he serves as the Regional Financial Risk, Controls, and Compliance Coordinator at CRH. Additionally, Terence is the visionary founder of InFluential Magazine Media, a distinguished lifestyle media brand celebrated for its powerful and engaging publications, earning multiple awards for its impact and influence.

Stephen Sargeant

Stephen Sargeant Stephen Sargeant, a distinguished compliance consultant and blockchain expert hailing from Toronto, Canada, is highly educated in Finance and Financial Management Services, with a background from Centennial College. He further honed his expertise through the Canadian Institute for Financial Crime Analysis’s Financial Crime Analysis Program.

Stephen’s proficiency extends beyond his consultancy role, as he shares his knowledge through instruction at the Canadian Institute for Financial Crime Analysis. Additionally, he invests in the social intelligence platform Trufan and hosts the podcast ‘We Were On A Break,’ where he delves into various compliance topics (unfortunately, not related to Friends). As the founder and Chief Web3 Officer of Airdropd Inc., a media production house, Stephen is dedicated to educating people about due diligence and compliance.

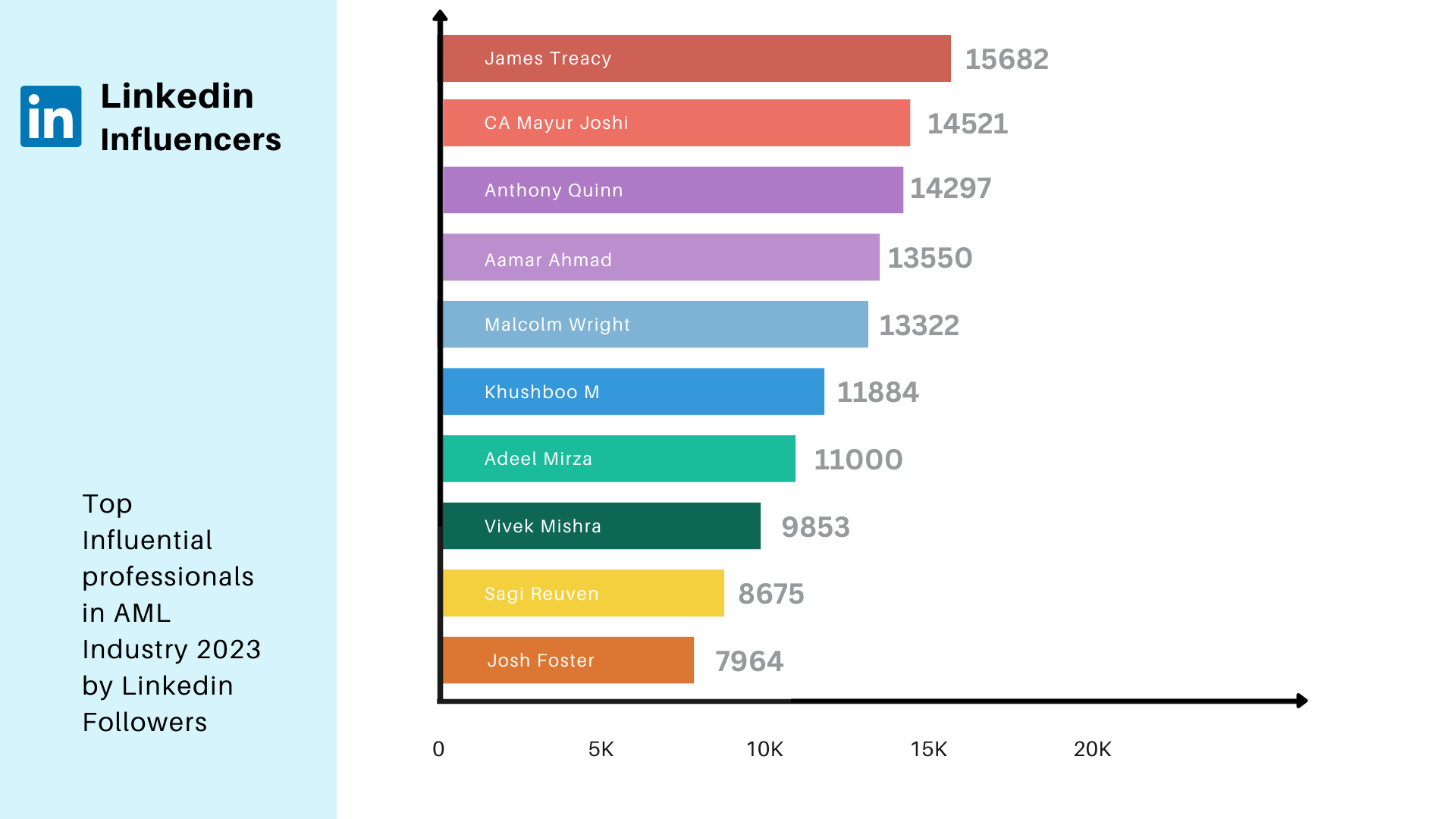

James Treacy

James Treacy James Treacy, an anti-financial crime professional based in Ireland, serves as the CEO and co-founder of AML Intelligence. His educational background includes a PG diploma in International Selling, Business, Management, Marketing, and related support services from the Technological University of Dublin.

With an entrepreneurial spirit, James has founded notable ventures, including BusinessPro consulting, StubbsGazette, and the International Fraud Prevention Conference. The latter, dedicated to combating fraud through technological innovations, showcases his commitment to advancing the field.

Currently, James is immersed in his venture, AML Intelligence, where he channels his expertise to assist businesses in combating financial crime and ensuring compliance with relevant regulations. His multifaceted approach reflects a dedication to both innovation and ethical business practices.

CA Mayur Joshi

CA Mayur Joshi CA Mayur Joshi, a distinguished anti-money laundering expert with over 20 years of experience in Financial Crimes, holds a prominent position in Risk Management, recognized by Thinkers 360 as one of the most influential professionals. Additionally, he serves on the board of Rashtra Raksha University, a University of National Significance.

As the founder of Indiaforensic, a global community with over 5000 members, Mayur has established Indiaforensic as a hub for AML education. Renowned for its Certified Anti Money Laundering Expert (CAME). course, it is widely regarded in the Indian Subcontinent.

Mayur’s influence extends to the cybersecurity domain, where he serves as a board member of EC-Council, a leading educational institute. With a prolific writing career, he has authored 8 books on Anti Money Laundering and financial crimes. His insights are regularly featured in newspapers and research papers, showcasing his authority in the field. Mayur stands out as a thought leader among AML influencers, contributing regularly on LinkedIn and shaping the discourse in the industry.

Anthony Quinn

Anthony Quinn, a distinguished RegTech and AML risk assessment expert based in Greater Sydney, Australia, is a seasoned professional with a Bachelor of Science in Business Administration from the University of Bath. Certified as an AUSTRAC Approved External Auditor, Anthony has a wealth of experience that spans prestigious institutions such as Accenture, Goldman Sachs, Morgan Stanley Dean Witter, ING, JP Morgan Chase, and the National Australia Bank.

In 2015, leveraging his extensive knowledge, Anthony founded Arctic Intelligence Compliance Solutions, where he currently serves as the director. Furthermore, he is the co-founder of AML Accelerate, a venture dedicated to assisting businesses in automating their AML/CFT risk assessment procedures. Anthony’s multifaceted expertise and innovative ventures reflect his commitment to advancing regulatory technology and mitigating AML risks in the business landscape.

Aamar Ahmad

Aamar Ahmad is a seasoned Subject Matter Expert in Anti-Financial Crime, offering invaluable guidance to Investment Banks, Private Banks, and multinational Oil and gas companies. Widely recognized for his expertise, Aamar has conducted impactful training sessions for global and regional banks across Europe and Africa, focusing on essential modules such as AML Risk Assessment, Money Laundering, and Correspondent Banking within Financial Crime training.

In his role as the Founder and CEO of Sigma Risk Limited, Aamar is deeply engaged in advising clients on a spectrum of aspects, including AML, Financial Crime, Trade Finance, Sanctions, Client Risk Reviews, Training, and Coaching. His dedication to professional development is evident through certifications like Cyber Risk Assessment Masterclass (ICTTF), ICA Fellow Membership, and ICA Certified Practitioner. Aamar Ahmad’s commitment to excellence and comprehensive understanding of Anti-Financial Crime make him a highly sought-after expert in the field.

Malcolm Wright

Malcolm Wright, a distinguished business leader and board advisor based in Hong Kong, stands among the world’s top Anti-Money Laundering professionals and influencers. Renowned for his expertise in applying AML principles to the crypto sector and blockchain concepts, Malcolm has played a pivotal role by collaborating closely with the FATF, the global intergovernmental AML watchdog.

As a member of the Global Coalition to Fight Financial Crime and Head of Regulatory at OKX, Malcolm has significantly influenced AML regulations in the virtual currency space. His impact extends into the crypto-trading realm, where he has worked with various platforms, holding C-level positions and contributing to breakthroughs in the crypto space.

Malcolm takes pride in his contributions to new and emerging concepts like NFT, DAO, and Defi Strategy in today’s rapidly digitalizing world. Notably, he has played a crucial role in deploying the FATF’s ‘Travel Rule,’ shaping data-sharing requirements for crypto firms. His deep knowledge and invaluable contributions have played a pivotal role in shaping the landscape of the crypto world as we know it today.

Khushboo M

Khushboo M, boasting over 6 years of professional experience in banking and MSB compliance, brings a wealth of expertise to her role. Her responsibilities include efficiently analyzing, identifying, and monitoring suspicious activities and transactions within both the banking and MSB sectors.

Leveraging AML monitoring software, Khushboo meticulously oversees these areas, ensuring the timely reporting of suspicious transactions in adherence to AML/CFT/CPE guidelines. She adopts a risk-based approach to shield institutions from the multifaceted risks of money laundering, terrorist financing, TBML, and proliferation financing.

Khushboo’s commitment to professional growth is evident through her certifications in Advanced Anti-Money Laundering, Trade Base Money Laundering, AML and Countering Terrorism Financing, AML Grey Matters – Sanctions Updates, Understanding Blockchain Technology, and expertise in sanctions and terrorism in crypto. Her dedication and diverse skill set contribute significantly to the robustness of banking and MSB compliance.

Adeel Mirza

Adeel Mirza, based in Dubai, is a seasoned professional holding certifications as a Certified Anti-Money Laundering Specialist, Certified Blockchain and KYC Professional, and Cryptocurrency Auditor. With an impressive 15+ years of experience in AML and due diligence, Adeel is an expert in cryptocurrency, blockchain, and the payments service industry.

Adeel earned his BCom degree in Accounting and Finance from the University of Karachi. His extensive career includes roles as a compliance officer and auditor with prestigious financial firms such as the Commercial Bank of Dubai, Delma Exchange, Noor Bank, and the Protiviti Middle East Member Firm.

Currently, Adeel serves as the Head of AML and KYC Unit for the Arab Bank for Investment & Foreign Trade (Al Masraf) in the UAE, contributing his wealth of expertise to the financial landscape in the region.

Vivek Mishra

Vivek Mishra stands out as a versatile business professional with a remarkable career spanning over 15 years. His extensive expertise covers a spectrum of domains, including AML & KYC compliance, risk mitigation, data analysis, due diligence, leadership, project management, issue resolution, KYC remediation, and fraud prevention.

Proficient in executing due diligence, analyzing data, and managing projects, Vivek ensures strict adherence to AML/KYC compliance standards. His noteworthy track record includes implementing robust risk mitigation strategies and devising processes to counter fraudulent activities.

Vivek’s commitment to continuous improvement is evident through his diverse certifications, including Certified Anti-Money Laundering Specialist (CAMLS), Fighting Modern Slavery & Human Trafficking, Certified Anti Money Laundering Expert, Shell Company Investigation, Forensic Accounting and Fraud Examinations, and Lean Six Sigma Black Belt (ICBB). His multifaceted skills and dedication contribute significantly to the realms of compliance, risk management, and fraud prevention.

Sagi Reuven

Sagi Reuven, a distinguished Anti-Money Laundering professional and business strategist hailing from Israel, currently holds the position of Head of Boosting AML Compliance for Fintechs and banks at ThetaRay. ThetaRay specializes in developing AI-powered AML transaction monitoring programs to assist businesses in diligently monitoring their cross-border transactions.

Sagi earned his Bachelor’s degree in Mechanical Engineering from Tel Aviv University and completed his MBA from Reichman University (IDC Herzliya). His expertise spans FinTech, SaaS, and compliance, making him a well-rounded professional in the industry.

Prior to his role at ThetaRay, Sagi served as the former Head of Business Development at Siemens Digital Industries Software, showcasing his diverse experience and transition into the Anti-Money Laundering domain.

Josh Foster

Josh Foster, an AML compliance professional based in Dubai, has charted an impressive career trajectory. He commenced his journey at FP Mailing, gradually ascending from a Cold Sales Executive to the esteemed position of Senior Account Manager. His professional journey continued with roles such as Senior Purchase Specialist, Public Sector Account Manager, and Software and Solutions Sales Manager at Pitney Bowes.

Presently, Josh serves as a Senior Partners Specialist at DX Compliance, an AML Transactions Monitoring & SAR Reporting Platform. With extensive expertise in AML concepts, AI, Machine Learning, and a thorough understanding of global regulations and sanctions, Josh passionately shares his knowledge with both seasoned and aspiring AML professionals. His commitment to knowledge-sharing and his comprehensive skill set make him a valuable asset in the field of AML compliance.

Wishing you all a Happy New Year in advance! As we conclude this list of top AML influencers curated by our dedicated team, we acknowledge the incredible contributions of these professionals in shaping the AML landscape. If your name is not on the list, we invite you to fill out the form, ensuring that you have the opportunity to be featured in our next influencers’ profile showcase. Here’s to a year filled with growth, success, and continued excellence in the world of AML!