In October 2024, the Reserve Bank of India (RBI) made a significant announcement: it decided to keep the repo rate unchanged at 6.5%. The repo rate, or interest rate at which the RBI loans money to banks, makes this decision significant. When the repo rate stays the same, it means that the interest rates for loans and mortgages from banks are also likely to remain unchanged. This news comes at a time when many other countries, including the United States and New Zealand, are cutting their interest rates. So why did India decide to maintain its rate while others are lowering theirs? Let’s dive into the details.

RBI’s Neutral Stance on Repo Rate

On October 9, the RBI held its monetary policy meeting, where it confirmed its decision to keep the repo rate at 6.5%. This is noteworthy, especially considering that many central banks around the world are opting for rate cuts. In an effort to promote economic growth, the Reserve Bank of New Zealand and the U.S. Federal Reserve, for example, recently reduced interest rates by 5.25% and 4.75%, respectively.

By keeping its rates steady, the RBI is taking a different approach than many global counterparts. It indicates a cautious outlook towards the economic situation in India, emphasizing a need to maintain stability in the financial system. The central bank’s decision reflects its ongoing commitment to manage inflation and support the economy’s growth trajectory.

Understanding Repo Rate

The repo rate is a critical tool used by central banks to control the money supply in the economy. When the RBI lends money to banks at this rate, it influences the interest rates that banks offer to consumers and businesses. If the repo rate is low, borrowing costs decrease, encouraging spending and investment. Conversely, a high repo rate can slow down borrowing and spending, which can help keep inflation in check.

As a result, when the RBI decided not to lower the repo rate, it sent a clear message: the focus remains on controlling inflation and ensuring that the economy remains healthy. This decision highlights the unique challenges that the Indian economy faces compared to other countries.

Why Not a Rate Cut?

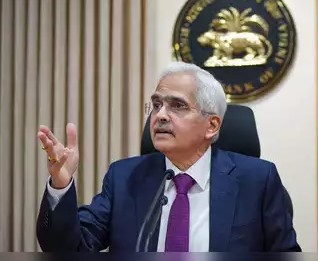

A primary reason for the RBI’s cautious approach is inflation. In his announcement, the RBI Governor highlighted the importance of being careful with monetary policy changes. He compared managing inflation to taming a horse; if let loose too quickly, it could cause a lot of damage. The RBI has been actively working to reduce inflation in recent years, and there are concerns that lowering interest rates too quickly could lead to a resurgence in inflation.

The RBI has projected that the Consumer Price Index (CPI) inflation will average around 4.5% for the year. While inflation figures showed some decline—3.6% in July and 3.7% in August—the RBI anticipates that these numbers could rise again.

Several factors contribute to this concern. The “base effect,” or the influence of the low inflation rates from prior years, is one important component. Since last year’s inflation was low, this year’s figures might appear higher by comparison. Moreover, geopolitical tensions, such as the ongoing conflict in West Asia between Israel and Iran, could result in a spike in global oil prices, adding to inflationary pressures. Additionally, rising food and metal prices are worrying trends that could influence overall price stability.

Transitioning from “Withdrawal of Accommodation” to “Neutral” Position

While the RBI chose not to cut rates, it did change its monetary policy stance from “withdrawal of accommodation” to “neutral.” This shift is significant and suggests a more flexible approach to economic management.

When the RBI adopts a neutral stance, it indicates that the central bank is open to adjusting its policies based on changing economic conditions. This flexibility allows the RBI to respond to new data, economic growth, and inflation without being tied to a specific course of action. It shows that while the RBI is cautious about inflation, it also wants to support the economy’s growth potential.

The RBI has maintained its growth forecast at 7.2% for the financial year 2025. While there was a slight decline in growth to 6.7% during the first quarter, this decrease was largely due to unusually high figures from the previous year, which made this year’s numbers seem lower. Additionally, government spending slowed down during the election period, but there are signs that spending has picked up again, which is promising for the economy.

The Bottom Line

The RBI’s decision to maintain the repo rate at 6.5% amidst a global trend of rate cuts reflects a careful balancing act. By choosing to hold steady on interest rates, the RBI emphasizes its commitment to managing inflation, especially in the face of potential pressures from geopolitical conflicts and rising prices. The shift to a neutral stance signifies that while the central bank remains vigilant about inflation, it is also prepared to respond to changes in economic conditions to support growth. This approach highlights the unique position of the Indian economy in a rapidly changing global landscape, showcasing the RBI’s strategic focus on maintaining financial stability.